CPA vs revenue share affiliate models is a hot topic in the affiliate marketing world, sparking interest among affiliates and advertisers alike. These models represent two distinct approaches to earning commissions, and understanding their nuances can lead to more effective strategies for generating revenue.

As we delve into the key differences, advantages, and disadvantages of each model, you’ll gain insight into which approach might suit your goals best. Whether you’re an affiliate looking to maximize earnings or an advertiser aiming for effective partnerships, this exploration is essential.

Understanding CPA vs. Revenue Share Models

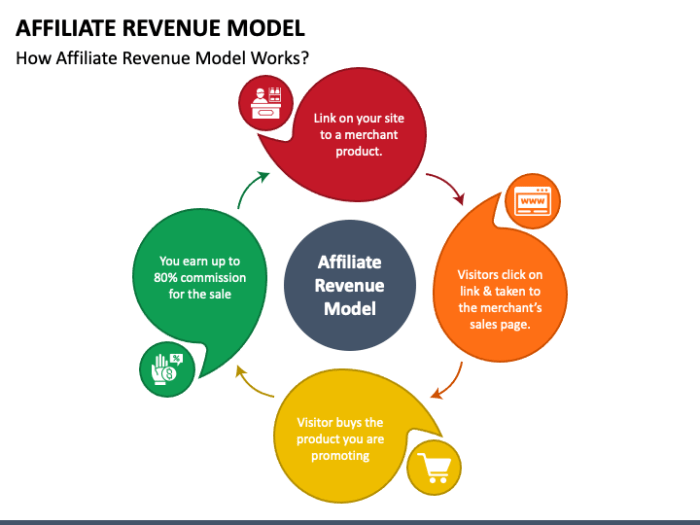

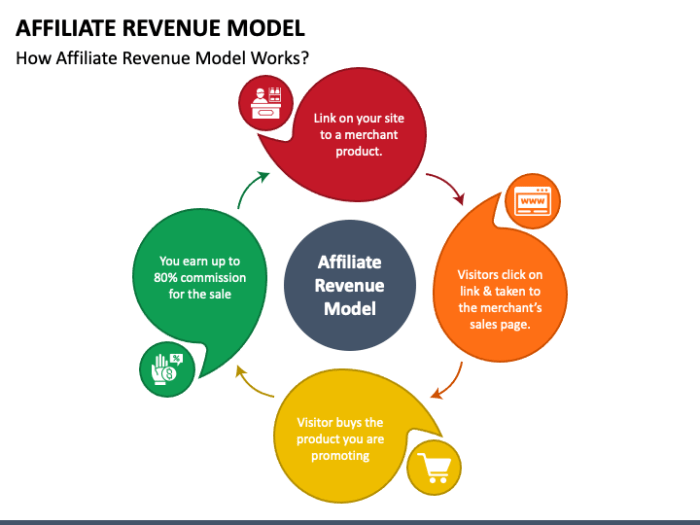

In the world of affiliate marketing, two predominant compensation models stand out: Cost Per Action (CPA) and revenue share. Each model offers unique mechanisms for rewarding affiliates and different implications for advertisers. Understanding the nuances of these models is essential for both parties to optimize their strategies effectively.The key difference between CPA and revenue share lies in how affiliates are compensated.

CPA is based on a specific action taken by the user, such as signing up for a newsletter or making a purchase. In contrast, revenue share provides affiliates with a percentage of the revenue generated from the referred customer’s purchases over time.

Advantages and Disadvantages of Each Model

When considering which model to adopt, it is important to weigh the benefits and drawbacks for both affiliates and advertisers. Here are the essential points to consider:

-

CPA Model:

- Advantages: Affiliates receive immediate payouts for specific actions, which can enhance cash flow and provide clarity on earnings.

- Disadvantages: Since earnings are tied to individual actions, affiliates may find their income inconsistent, especially during slower periods.

- Revenue Share Model:

- Advantages: Affiliates can earn ongoing income as long as the customer continues to make purchases, which can lead to higher long-term earnings.

- Disadvantages: The payout timeline is longer, and affiliates may need to invest more effort into nurturing customer relationships to maximize their income.

For advertisers, choosing between CPA and revenue share can depend on several factors, including budget constraints and campaign goals. CPA might be preferable for campaigns focused on immediate results, while revenue share could be advantageous for long-term customer acquisition strategies. Each model presents unique risks and rewards, making it essential for advertisers to align their choice with their overall marketing objectives.

“The decision to choose CPA or revenue share should be informed by the campaign’s goals, targeted customer behavior, and the expected lifetime value of customers.”

Impact on Affiliate Revenue

The choice between CPA (Cost Per Action) and revenue share affiliate models significantly influences an affiliate’s earning potential. Each model has unique characteristics that determine how commissions are calculated and paid out, thereby affecting overall revenue. Understanding these differences is essential for affiliates aiming to optimize their income.In the CPA model, commissions are typically calculated based on a specific action taken by the customer, such as signing up for a service or making a purchase.

Affiliates receive a fixed amount per action, providing predictable earnings. Conversely, the revenue share model involves affiliates earning a percentage of the sales generated through their referrals, often leading to potentially higher long-term earnings if the referred customer continues to make purchases. This distinction is crucial as affiliates assess which model aligns best with their marketing strategies and target audience.

Calculating Commissions in CPA and Revenue Share Models

The method of calculating commissions varies between CPA and revenue share models, impacting affiliates’ revenue strategy. In CPA, affiliates earn a predetermined amount for each successful conversion. For example, if an affiliate earns $50 for each sale they generate, their total earnings will depend solely on the number of conversions achieved.In contrast, the revenue share model typically pays affiliates a percentage of the total sales made by the referred customer.

For instance, if an affiliate receives a 20% commission on a product that sells for $100, each sale leads to an earning of $20. The crucial point here is that while CPA offers immediate rewards for conversions, revenue share can lead to increased earnings over time if the customer maintains ongoing engagement with the brand.

Maximizing Earnings in Both Models

To optimize earnings across both CPA and revenue share models, affiliates can adopt various strategies tailored to their chosen approach. For CPA affiliates, focusing on high-converting offers and optimizing marketing campaigns can significantly boost revenue. Leveraging tools such as A/B testing and analytics helps identify the most effective channels and messaging to drive conversions.For those in revenue share models, building a strong relationship with customers can enhance long-term earnings.

Affiliates should aim to create engaging content that encourages repeat purchases, such as product reviews, tutorials, and personalized recommendations. Additionally, utilizing email marketing and loyalty programs can nurture customer retention and increase the likelihood of future sales.

Challenges in Model Selection for Affiliates

Selecting the right affiliate model can be challenging due to various factors that impact an affiliate’s niche and audience. Affiliates must consider the nature of the products or services they promote, as some may lend themselves better to one model over the other. For example, high-ticket items may work well with CPA, where immediate conversion is paramount, while subscription-based services could benefit more from revenue share due to recurring commissions.Furthermore, affiliates might face the challenge of lower initial payouts in revenue share models, which can be less appealing compared to the immediate rewards of CPA.

This can lead to frustration if the long-term benefits of revenue share are not clearly understood. Affiliates must conduct thorough research and consider their marketing capabilities, audience behavior, and product lifespan before committing to a model to ensure sustainable revenue growth.

Related Topics in Affiliate Marketing

The landscape of affiliate marketing is shaped by various factors that influence revenue potential and strategies. Understanding these related topics can provide insights into how external elements affect affiliate performance and profitability. This section explores key areas such as workers’ compensation, internet auctions, and the rise of audio streaming, highlighting their implications for affiliate marketers.

Implications of Workers’ Compensation on Affiliate Revenue

The impact of workers’ compensation on affiliate revenue is nuanced and varies across different industries. In sectors like construction and manufacturing, where injuries are more prevalent, higher insurance premiums can affect how much companies are willing to invest in affiliate partnerships. For instance, businesses may allocate fewer resources to marketing initiatives if they are burdened by high workers’ compensation costs.

This scenario can lead to reduced commission payouts for affiliates. In contrast, industries such as technology or e-commerce, where the risk of physical injuries is lower, may have more stable revenue streams and thus can afford to invest more heavily in affiliate programs. This results in better compensation structures for affiliates, which can be crucial for long-term relationships.

“Businesses in lower-risk industries tend to have more flexibility in their marketing budgets, leading to potentially higher affiliate commissions.”

Effects of Internet Auctions on Affiliate Marketing Strategies

Internet auctions, such as those conducted on platforms like eBay or Amazon, significantly influence affiliate marketing strategies. The competitive nature of auctions requires affiliates to adopt unique approaches to capture the attention of consumers. For example, affiliates may focus on promoting products that are frequently auctioned, leveraging bidding trends to optimize their marketing strategies.Additionally, auction-based pricing can lead to fluctuating revenue opportunities.

Affiliates need to stay agile, adjusting their content and promotions based on real-time auction dynamics. A successful strategy might include creating content that educates potential bidders on the benefits of participating in auctions, thereby enhancing traffic and conversions for affiliated products.Understanding how auction mechanics work can give affiliates a competitive edge, enabling them to tailor their marketing efforts effectively.

Growth of Audio Streaming and Affiliate Revenue Opportunities

The audio streaming industry has experienced unprecedented growth, presenting new avenues for affiliate revenue. With platforms like Spotify and Apple Music soaring in popularity, affiliates have the opportunity to tap into a vast audience interested in music, podcasts, and audiobooks. Affiliates can leverage affiliate programs to promote subscription services, offering audiences unique deals or trials. For example, an affiliate could create a blog post recommending the best audiobooks available on a streaming platform, including affiliate links for readers to sign up.

The allure of exclusive content, combined with personalized recommendations, drives higher conversion rates.In addition to traditional subscriptions, partnerships with content creators for sponsored segments can further enhance affiliate revenue streams. Affiliates can work collaboratively with podcasters or musicians to promote products or services that resonate with their audience, ensuring a more authentic marketing approach.This growing sector emphasizes the need for affiliates to stay updated on trends and consumer preferences, enabling them to identify and capitalize on emerging opportunities for revenue generation.

Closure

In conclusion, grasping the intricacies of CPA vs revenue share affiliate models empowers affiliates and advertisers to make informed decisions. By analyzing the benefits and challenges of each model, you can tailor your strategies for optimal success in the ever-evolving landscape of affiliate marketing.

FAQs

What is the main difference between CPA and revenue share?

The main difference lies in the commission structure; CPA pays affiliates for specific actions, while revenue share pays based on a percentage of sales generated.

Which model is better for new affiliates?

New affiliates may benefit more from CPA models as they provide immediate payouts for specific actions, reducing the time to earn commissions.

Can I use both models simultaneously?

Yes, many affiliates use both models to diversify income streams and adapt to different campaigns and niches.

How can I choose the right model for my niche?

Consider factors like your audience, product types, and your ability to drive actions versus sales when selecting a model.

What challenges do affiliates face in these models?

Affiliates may encounter challenges such as understanding commission terms, maintaining compliance with advertiser requirements, and optimizing their marketing strategies for each model.